Future of banking for financial inclusion

UX strategy

Value proposition

Future vision and journeys

Client: Banking

Designed for: Designit

How can we leverage digital transformation to design a new banking experience that is more inclusive, efficient and seamless?

Objective

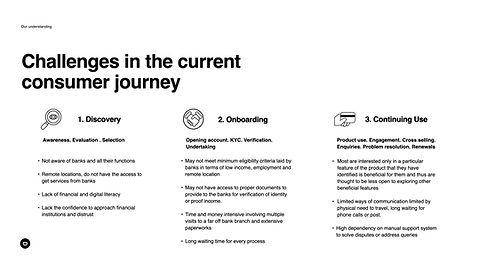

Over a couple of years, Designit witnessed a surge in existing and potential banking clients approaching them for re-designing their banking experience to be digital-first, user-centric, and more efficient. They expect this transformation to result in reduced dependency on manual processes and thus reduced error rates, processing time, and operational costs; increased financial inclusion and thus acquiring new customer segments; and delivering elevated customer experience resulting in higher customer retention and a thriving business.

We responded by creating our POV on this ask with future visioning and customer journeys.

Approach

This POV is a culmination of multiple proposals and opportunities that we have worked over the years for several of our clients including HSBC, Ujjivan Bank, RBI. We spoke to several of our Wipro SMEs from UK and India to understand the back-end operations impacting the customer experiences, technological and policy interventions in the domain and business objectives of the various banks who are our current and potential clients.

We also conducted in-depth secondary research on industry and trend forecasts and current on-ground practices and challenges.

Banking trends for Indian consumers

Experience principles for increasing financial inclusion

Features for the future banking platform

Future journey for new account opening and onboarding

Future journey for dispute resolution